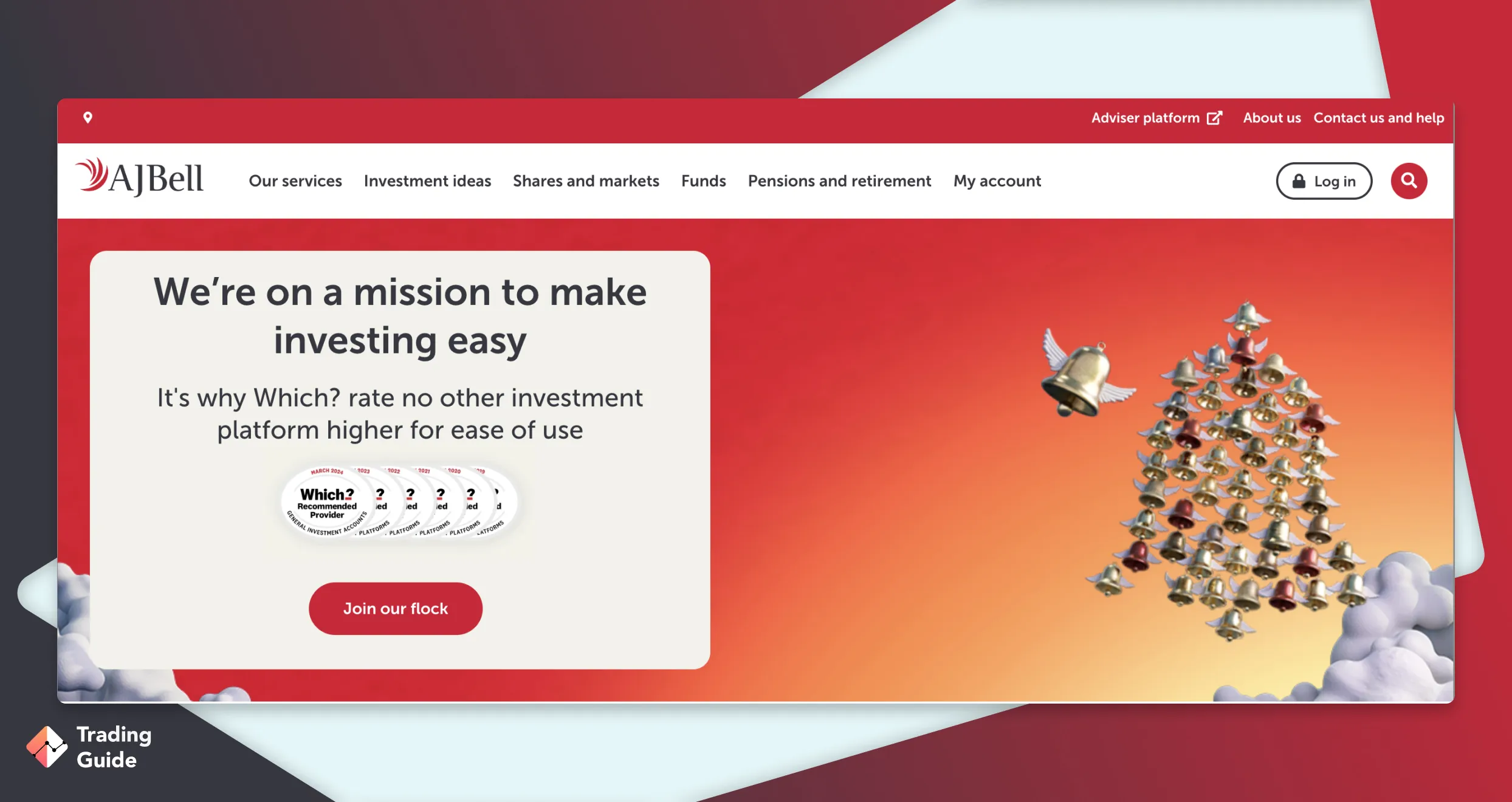

AJ Bell Youinvest is an online trading name of Youinvest Fund Limited, a part of the AJ Bell group. The company is one of the largest fund management and stockbroking platforms in the UK.

- Fast account opening

- User-friendly trading platforms

- Perfect customer service

- No MetaTrader platform

- Lack of educational materials

AJ Bell Youinvest is a broker for anyone who wants to trade online on the United Kingdom’s stock market. It is a British brokerage firm that offers its users to trade from its online platform, with no withdrawal fee amount required.

We have spent countless hours testing AJ Bell’s trading platforms in detail. We have also analysed the reviews of active customers from Google Play, the App Store and Trustpilot, studying all the advantages and disadvantages. Below, we gladly share our results with you.

AJ Bell – Who Are They?

AJ Bell Youinvest was founded in 1995, and it is one of the biggest discount brokers in the UK. It has been among the first companies in the country to try and attract ordinary investors and offer them free investment products.

AJ Bell YouInvest is a broker offering online trading on various asset classes with advanced trading platforms. They provide shares, ETFs, and CFDs, alongside options, funds, and bonds through their sophisticated website.

The research tools are easy to use and give professional-quality analysis. A novice investor could easily utilise the tools and be 100% satisfied. In fact, this is who it is aimed at – there are easy-to-use tools, such as basic stock market data, specific share analysis, and charting, that will appeal to a novice investor.

| Type | Fee |

|---|---|

| Minimum Deposit | ISA accounts: £250 Dealing accounts: £250 Pension accounts: £500 |

| Deposit Fee | No deposit fee |

| Withdrawal Fee | No withdrawal fee |

| Inactivity Fee | No inactivity fee |

| Annual Fee | Depends on the fund value (from 0 to 0.25%) |

Compare AJ Bell Features With Other Brokers

Compare brokers

Our Opinion About AJ Bell

We want to highlight that AJ Bell offers downloadable platforms, with a simple and easy-to-use design. There is a standardisation of the layout, which makes navigation around the website relatively straightforward. However, the research section is mainly designed for novice investors, who are likely to find meaningful data on transactions, holding periods, and performance data.

AJ Bell Youinvest also has excellent educational materials, including its own YouTube channel with 600+ useful videos. These are all educational tutorials so that you can learn on your PC, tablet, or mobile. Their courses are personalised to suit your level of investment experience, so you can use the tutorials regardless of whether you’re a beginner or an experienced investor.

FAQs

Absolutely. You can trust AJ Bell since it is licensed and regulated by the Financial Conduct Authority (FCA). Having a licence from FCA means it must adhere to stringent regulations that ensure all traders receive the best trading services.

AJ is a publicly traded company, and anyone can own its shares. The company was founded in 1995 by Andy Bell and Nicholas Littlefair. It went public in December 2018 on the London Stock Exchange under the ticker AJB.

Andy Bell is the largest shareholder of AJ Bell, with a 22.8% ownership share, followed by asset managers Liontrust (10%), Capital Research & Management Co. (4.45%), and BlackRock (4.12%).

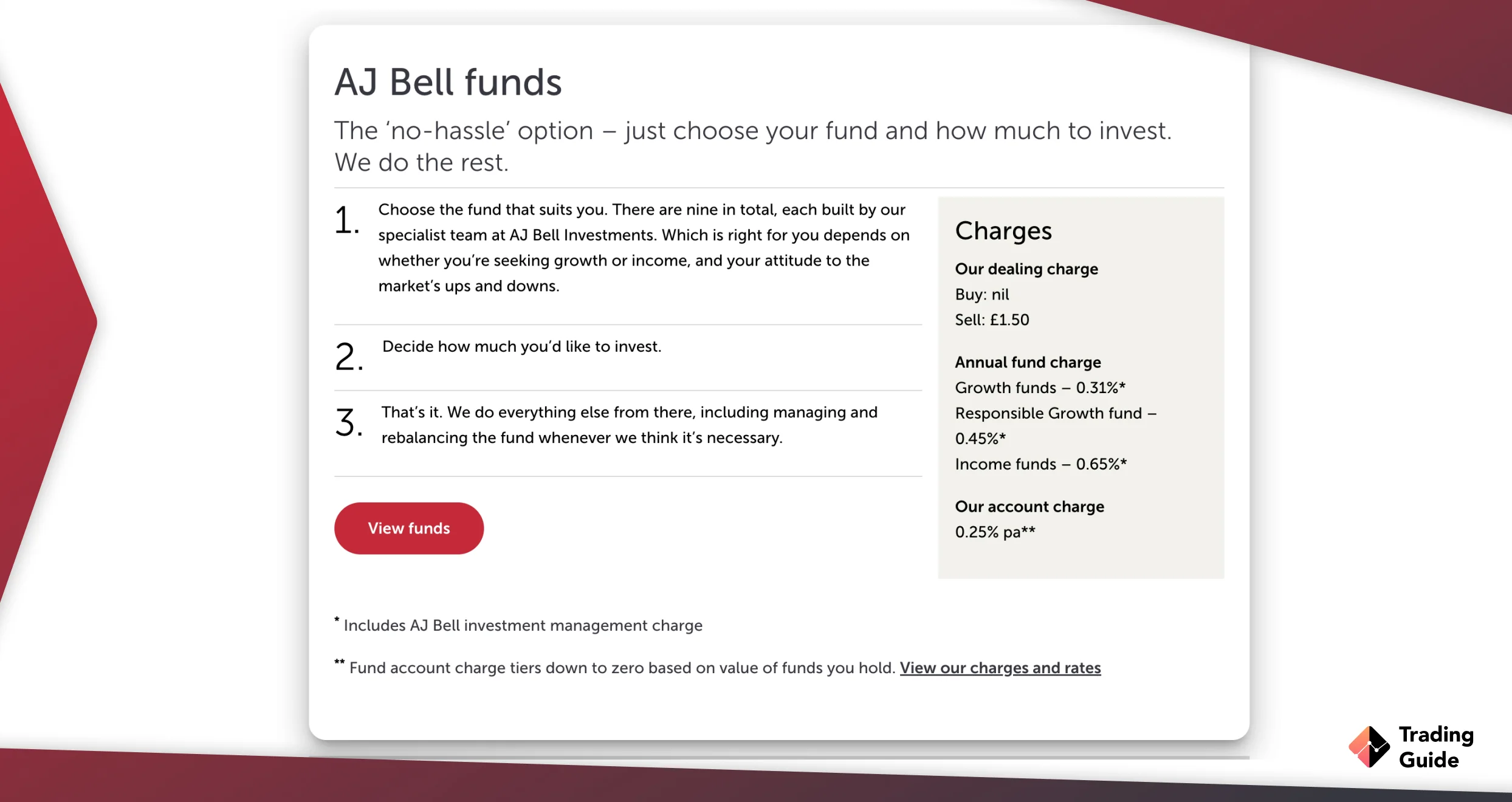

AJ Bell offers more than 2,000 funds from which you can invest. The funds are spread across multiple asset classes, sectors, regions, and investment strategies. However, the broker simplifies the funds for users who like to be guided in their investment journey by providing the AJ Bell Favourite funds list, which is its selection of the best funds.

AJ Bell offers six account types that cater to different types of investors. These include SIPP, Stock & shares ISA, Lifetime ISA, Dealing account, Cash savings hub, and Junior ISA.

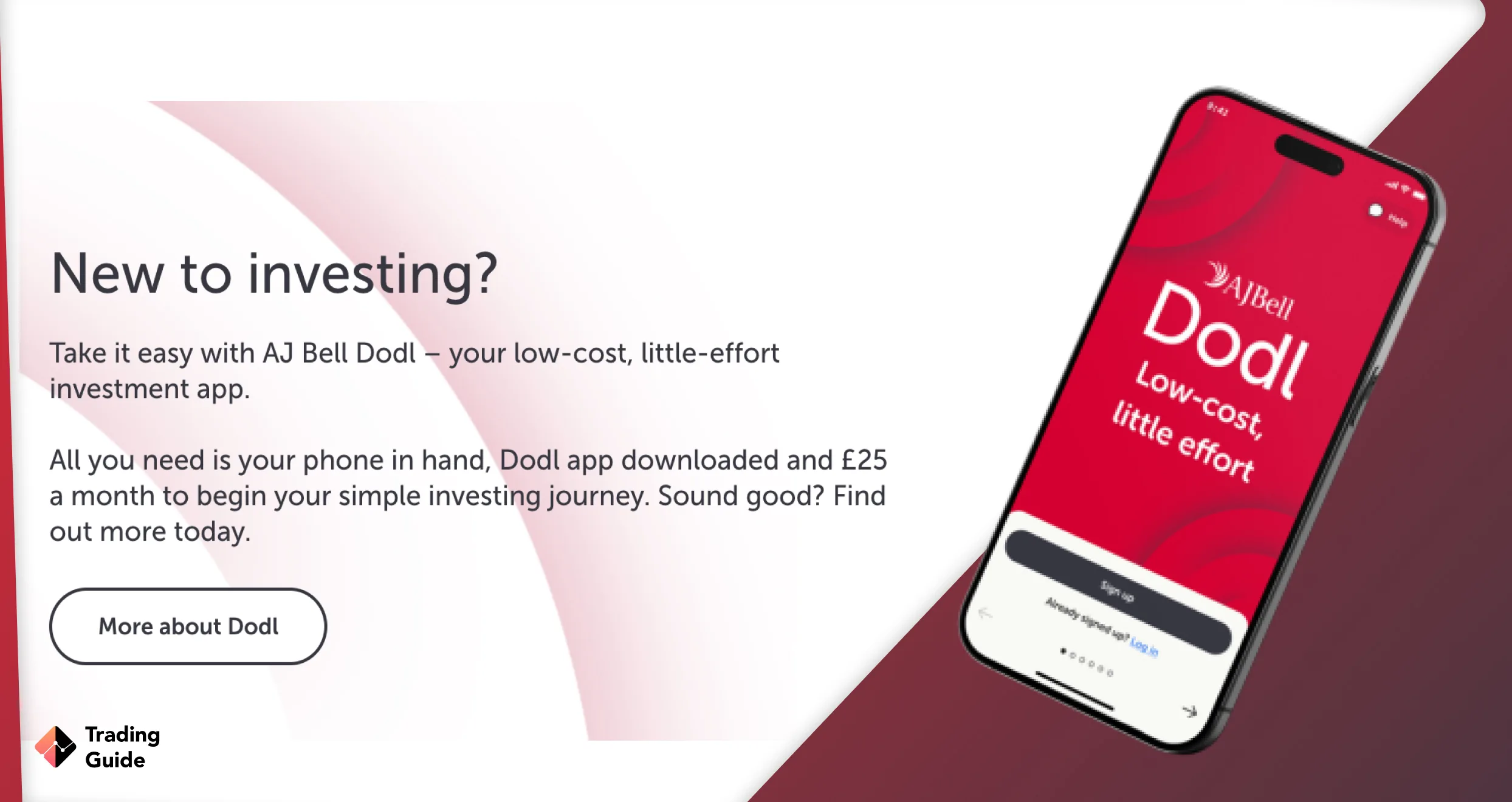

Yes. AJ Bell is a solid choice for beginners looking for a simple and easy-to-use platform with zero minimum deposit requirement for trading various asset classes. Plus, the broker provides excellent educational resources, including its YouTube channel with hundreds of useful videos, to help beginners maximise their experience and potential. As a newbie, taking advantage of these comprehensive resources will help you quickly improve your skills to become independent. Unfortunately, the broker does not offer a demo account.

It is possible to make money with AJ Bell, I made £320 in one day!

I found what I needed here. I can say that I had two reasons to open a real account with this broker. The first reason is that they offer very good spreads and I can trade all assets here without commission. It’s a very crucial nuance for me because sometimes I trade up to 10-12 hours a day and respectively commission-free allows me to save money on each trade. You know it’s impossible to trade the whole day long without a certain percentage of losing trades and when you need to pay a commission, it makes things worse. I like the possibility to trade without commission. ETFs are the second reason to trade here. Some brokers don’t support ETFs trading, while for the last time I have addicted to them.

Whatever your level of trading experience or demands I think AJ Bell is right place to be. One type of account fits with majority of trading needs. New traders will be glad to see no minimum deposit, no trading commission and 100% first deposit bonus. For experienced traders leverages size, spreads and amount of trading instruments with advanced tools for trading platform will be interesting. vps is a feature that can change your trading itself. Read about it.

Their Web interface is very effective - simple and fast. They cover many international exchanges. Their trading charges are fair. Good customer service. International trading is ok but maybe a little expensive for me. I have been a pleased customer for many years.

Silvy Vignola

I have been using AJ Bell for two years and I want to say the service is excellent. User-friendly, easy to navigate, and there is a lot of informative information available. I had an excellent experience with customer support.

Overall great platform with loads of options to invest in different products. AJ Bell has an easily navigable website. The customer team is super. I am very happy and secure placing my trust and finances with them.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

I've always found AJ Bell extremely helpful, especially when communicating over the phone. Their customer service has always been top-notch, with operators responding promptly to calls without long waits. Their website is easy to navigate. Discovering SIPP with them was a pleasant surprise. While there are cheaper providers out there, my experience has shown that they might offer a more limited range of products and their customer service may not be as good as AJ Bell.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal